The Particulars of Pet Insurance

You love your furry family member. That’s why you want to give them the best care possible, which includes medical care. However, veterinarian costs can be high. That’s why you should consider insurance to cover the costs should your pet have an accident or come down with an illness.

But what exactly is pet insurance? What costs will it cover and what are the costs to you?

Let’s take a look at the answers to those questions, some of the particulars of a typical policy’s fine print, and some other options you may have for taking care of your animal companion.

An Overview

For any type of insurance, we hope we never need to use it. However, just knowing it’s there for us in case we do need it gives us substantial peace of mind. The same goes for pet insurance.

The following items are usually covered:

Preventative Care

Illnesses

Chronic Conditions

Accidents

Behavioral Issues (anxiety, for example)

To get coverage for your pet’s vet bills, purchase a policy by making a monthly payment to your insurance company. Once you have reached your deductible, the rest of the receipt is paid for (or reimbursed by) your insurer.

It’s simple!

Understanding the Fine Print

Although the process of obtaining pet insurance and filing a claim is simple, there are quite a few details you need to be aware of ahead of time to get the most out of your particular policy.

Here are some of the most common fine print items to understand before you sign a contract for coverage.

Coverage Requirements

Before you can purchase insurance, some companies may have the following requirements:

Your pet must be able to pass a physical exam.

Authorized access to all past veterinary records.

You wait 1-2 weeks after your policy becomes active before making a claim.

Premium

The monthly payment you make to your insurer for coverage.

Copay

The out-of-pocket amount you will pay for each claim.

Deductible

The out-of-pocket dollar amount you must reach before insurance is applied to any claim.

Caps

Generally, there are three caps that can come into play depending on your policy:

Per-Incident Cap: The limit your insurer will pay for each incident. Take note that “incident” may be defined differently depending on the policy.

Period Cap: The limit your insurer will pay for your pet within a specified time period, such as a year.

Lifetime Cap: The maximum amount your insurer will pay over the life of your pet. Once it’s met, your pet will no longer be covered.

Exclusions

Exclusions are not covered by your pet insurance policy. Policies differ but the following are a few examples:

Specific-breed exclusions

Pre-existing conditions

Congenital conditions

Hereditary conditions

Developmental conditions

Sometimes an additional rider can be purchased to cover such exclusions.

Qualifying Vets

Some insurers require your pet to be seen by one of their “qualifying vets”.

Accepted Procedures

Few policies cover experimental, investigative, or non-generally accepted procedures.

Prescription Drugs

While some insurance providers include prescription drug coverage in their policies, many do not.

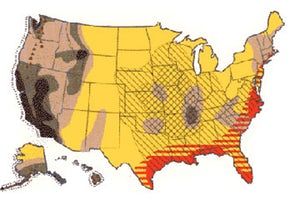

Traveling with Your Pet

You might want to check with your insurer to be sure coverage is valid while you are traveling with your pet.

Veterinary Costs vs. Insurance Costs

An animal companion can be a wonderful and worthy investment...but they are an investment. It may seem like a lot of money to spend on veterinary care, but if your pet is safe, healthy, happy, and loved then they will give you all of that back and more.

Vaccinations = $10-$150 per year

Spay or Neuter = $50-$300

Yearly Routine Veterinary Care = $500-$1000

Emergency Surgery and Hospitalization = $2000-$8000

Long-term Medication and Blood Work = $2000-$10,000

Contrast the above costs to those of insurance coverage (an average of $500 per year plus your copay and deductible) and you can see how quickly you can come out ahead.

Your Other Options

Veterinary Financing

A pet healthcare credit card such as CareCredit or Vetary is accepted at many veterinary clinics and covers most procedures. It differs from other credit cards by extending special financing options that you may not get otherwise.

Pet Health Savings Account

You can self-insure your pet by setting up a personal savings account specifically for your pet’s medical expenses and contributing to it regularly. This is a great, flexible option if you would rather not sign a contract but want to save enough cash to cover eventualities.

Homeowner/Renter Insurance

Depending on the species and breed of your pet, you will want to be sure you have adequate homeowner/renter insurance to cover medical expenses and personal liability should your pet be at fault for another person’s injury or property damage.

For more information on pet or homeowner insurance, contact Insurance Center Associates today!